COVID-19 has changed driver behavior—here’s how to bounce back

A great customer experience is everything.

Creating brand loyalty in today's computerized world requires excellence and speed at every step of the automotive customer lifecycle, from first contact to repurchasing. If your dealership can't keep pace, we can guide you through a digital transformation to streamline your operations.

We provide a comprehensive and tailored solutions suite that converts manual tasks and face-to-face interactions to the digital applications you need to create a fantastic customer journey.

Many aspects of consumer behavior have changed in the wake of the COVID-19 crisis, creating new challenges as well as fresh opportunities for automotive companies. Of the challenges, perhaps the most obvious and alarming trend for automotive manufacturers is the dramatic change in vehicle usage. While auto companies can overcome the need for more social distance and touchless transaction options, the rapid shift in vehicle usage runs the risk of upending the auto industry over the next 5-10 years.

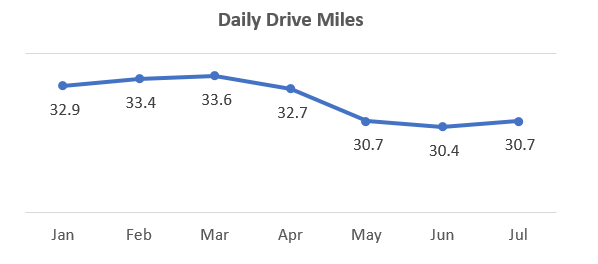

Based on a study of over 6M drivers who visited a dealer for service in 2020, Affinitiv found daily drive miles have declined 8-10% since the pandemic started. Fortunately for auto manufacturers, however, driving behavior is starting to show some slight signs of recovery in July vs. June.

We calculated daily drive miles using the vehicle mileage between the service visit in a given month and the mileage at the prior service visit. Since the prior service visit may have been 6 or 12 months ago, the daily drive mile calculation is likely to include both COVID-19 and non-COVID-19 driving habits—and is likely to underrepresent the true impact of the pandemic. We believe the decline in daily drive miles is even more severe when you factor in consumers who simply stopped using their vehicle and haven’t had a need for service lately. As further support for a larger decline, Affinitiv also conducted a survey with 1,000 auto consumers during the crisis and found the average consumer was only driving 30-35 miles per week.

Regardless of the exact extent of the decline, auto manufacturers will have a significant challenge if this trend continues. In the short term, consumers may delay service visits since it will take more time to reach the manufacturer-recommended maintenance miles. Over time, vehicle sales may also decline as consumers choose to delay the replacement of their vehicle due to lower usage and lesser wear and tear.

To overcome both the near- and long-term risks, retailers should take a proactive approach to their service business. Educating consumers about the importance of servicing based on both the time since their last visit plus vehicle mileage will help manage the current decline in traffic. As such, retailers should check that their service marketing programs incorporate time into the business logic, and upgrade their program if it is solely using mileage between visits. To address the longer-term risk of delayed vehicle replacement, auto manufacturers should push innovation faster and create more compelling reasons to upgrade to a new vehicle. Accelerating the pace of change with in-vehicle technology—and fostering deep relationships with consumers during the ownership lifecycle—will not only help you understand their changing needs, but will also be critical success factors for auto manufacturers and retailers moving forward.