Learning from the Onset of COVID-19

A great customer experience is everything.

Creating brand loyalty in today's computerized world requires excellence and speed at every step of the automotive customer lifecycle, from first contact to repurchasing. If your dealership can't keep pace, we can guide you through a digital transformation to streamline your operations.

We provide a comprehensive and tailored solutions suite that converts manual tasks and face-to-face interactions to the digital applications you need to create a fantastic customer journey.

As every company struggles to deal with the impact of the COVID-19 crisis on everything from employee health and safety to overall financial stability, we realize these are uncharted waters. However, we’ve discovered an opportunity to shift the marketing focus and lessen the severity on manufacturers and retailers like you.

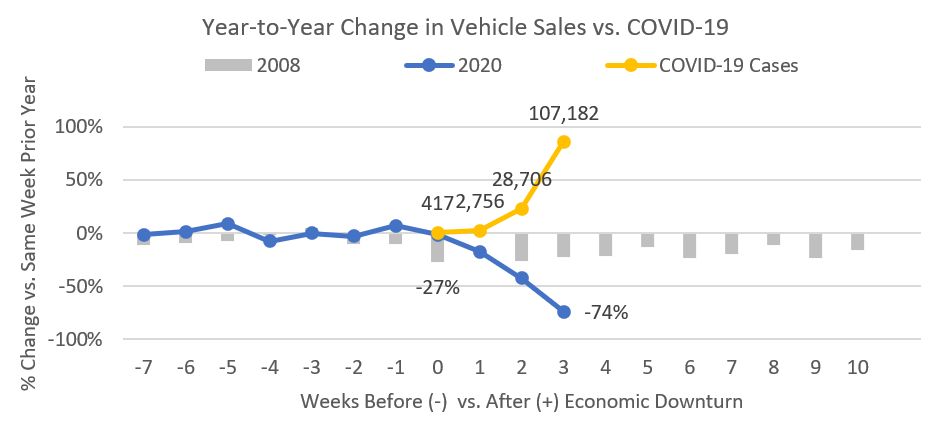

Recounting the stock market crash in 2008, we thought there could be valuable lessons to use as guideposts for navigating the current crisis. Yet our early COVID-19 research indicates the shift in spending patterns is dramatically different and much more volatile than in 2008. Based on a comparison of a national sample of over 200 dealers—where we had sufficient history to compare back to their results in 2008—we found some unique differences in this crisis versus the prior one. To create the comparison, we leveraged data from the week of the stock market crash starting on September 29, 2008. Then, we used data from the week of March 2, 2020 for the COVID-19 crisis, as this was when we saw substantial reports of COVID-19 cases in the U.S.

Thus far, the primary differences we noticed at the start of this crisis versus the recession in 2008 are:

- Rapid loss of sales

- Increase in trade-in activity

- Shift towards loans and new-vehicle purchases

The decline in vehicle sales in 2008 pales in comparison to the COVID-19 crisis we have been living through over the past few weeks. In 2008, we experienced sales declines in the 20-30% range after the downturn started—while in 2020, we have reached a near catastrophic 80% decline in just 3 weeks. The COVID-19 crisis has forced many dealers to close their showrooms and rely solely on online sales, if available. For dealers who continue to sell cars, we found some opportunities to better appeal to customers who have the means and are ready to buy.

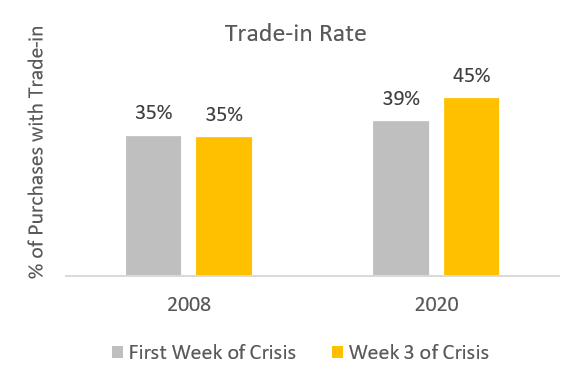

As unemployment skyrockets and consumer confidence rapidly erodes, consumers who are buying vehicles are trying to stretch their spending power as evidenced by the dramatic increase in the percent of vehicle purchases with a trade. While trade-in rates were relatively stable at the start of the 2008 crisis, in just 3 weeks of the COVID crisis, trade-ins have already jumped 15% from 39% of vehicle purchases in the first week to 45% in week 3.

To attract the significantly fewer buyers in this crisis, dealers should create a robust online trade-in strategy. Simply providing an estimate online is insufficient. Our past research about trade-ins has shown that providing a guaranteed value in the online trade process is the most important factor for consumers who use a trade-in tool. Given the high risk of infections with face-to-face interactions, providing guaranteed online trades is even more critical today than ever before.

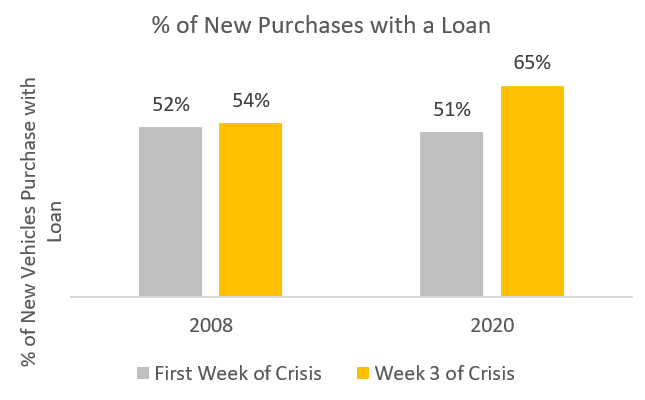

Another significant difference with the COVID-19 crisis and the 2008 recession relates to the financing options used by consumers. In 2008, bad loans and foreclosures created a shortage of money for consumers who wanted to borrow, which gradually impacted vehicle purchases over the first few months of the downturn. The COVID-19 crisis is starkly different, since consumers worry about keeping their jobs and paying bills. As a result, in just 3 weeks, we’ve seen the percent of new vehicles purchased with a loan grow 27% from 51% of purchases in the first week to an astounding 65% today.

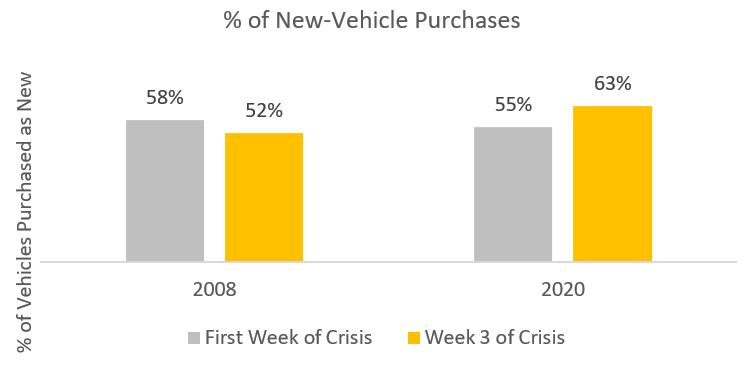

Perhaps the biggest change between the start of the 2008 recession and the COVID-19 crisis relates to new and used vehicles. In 2008, many consumers switched from buying new vehicles to used vehicles given the difficulty of securing loans and unfavorable financing terms. In contrast, during the start of the COVID-19 crisis, consumers with hourly jobs were more likely to be impacted early on, creating a higher percentage of higher income buyers in the market for new vehicles. As a result, the percentage of purchases for new vehicles at the start of the COVID-19 crisis has increased by 15% compared to a 10% reduction in new-vehicle purchases at the start of the 2008 recession.

If you’re an auto dealer who still has the means to sell cars, adjust your online trade-in process and your marketing strategy around it. Doing so will not only help you adapt to changing consumer buying patterns, it’ll help you maintain long-term success. Right now, online trades with guaranteed values and minimal human interaction are key to capturing a potential buyer. Implement the right tools and processes, then place a greater emphasis on trade-ins, loans, and new vehicles in your marketing communications to help maintain your business.